Portfolio Changes & Economic Commentary for Q3 2022

Inflation continues to dominate the conversation

A year ago, we began our market commentary with the following sentence (click here to go back in time and read the whole thing): “As we put the first half of 2021 behind us and look to the end of the year and beyond, one thing is on everyone’s minds: Inflation.” As we started to put this report together, Bob and I both had a strong sense of Deja Vu, since inflation, and the Federal Reserve’s response to it, are still the most important factors influencing the markets and the performance of our portfolios.

In this post, we’ll share our current thoughts on the markets, focusing on inflation and interest rates and our predictions – at the end of the post you’ll find reports on each of the four model portfolios we’re managing, along with the changes we’re making to the models. Please note that we will be rebalancing all portfolios, so the actual trades in your account will differ from the changes to the portfolios. Please email, text or call us if you’d like to review the trades in your account or touch base about your investment strategy.

Before we get to the analysis and model updates, a quick update on our newsletter – we recently changed from the newsletter vendor we’ve been using for years to a new one that has a more updated look and feel, and which produces content that’s easier to read and engage with. Here’s a link to the most recent edition! If you’re just looking for a quick update on the markets, and don’t want to go deeper into the ‘stats for nerds’ that we’re known for, maybe start there!

So, What the heck is going on in the markets?

and why are things moving so quickly?

First, a high level overview:

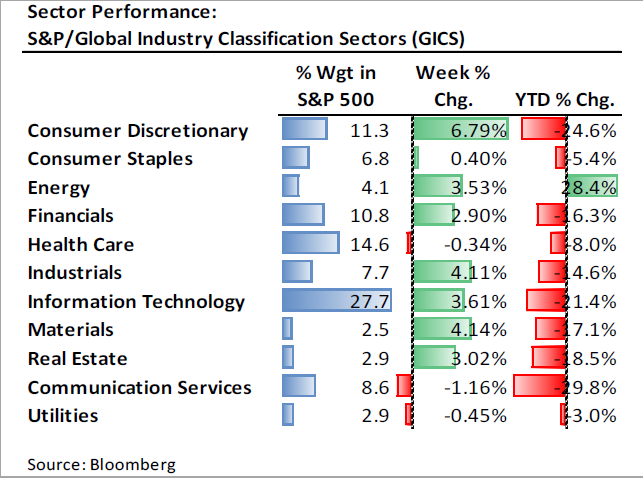

- The chart on the right looks at the makeup of the S&P 500, and shows the performance of each part of the index for the week that ended on 7/15/22 (all returns there are as of that date) – as you’ll see, the only sector of the economy that was up year to date was energy. As sustainable investors, our portfolios have generally avoided extractive oil & gas investments, which has caused these portfolios to underperform slightly for the year so far.

- Bonds, which typically serve as a counterweight in our portfolios to reduce volatility, have also dropped in value this year, with the Barclays’ Intermediate Bond Index down over 10% year to date (as of 7/18/2022).

- This was the worst first half of the year in more than 50 years. At the heart of this year’s stock market slump is the increasingly hawkish monetary policy employed by the Fed and other central banks. The Federal Reserve hiked interest rates by 75 basis points in June. Chair Powell signaled fighting inflation is the central bank’s top priority, and that the path to a “soft landing” may be challenging.

- We believe that inflation peaked in June and is beginning to come down, driven in large part by decreases in fuel costs and shipping costs (more on this including charts later), but that significant uncertainty remains, and that the global economy is still vulnerable to sudden and unexpected shocks.

- The Federal Reserve raised interest rates by another 0.75% on 7/27/22, and the markets reacted extremely positively to this news, with the technology heavy NASDAQ index up over 4% in a single day on the news. “Recent indicators of spending and production have softened,” the Fed said in its policy announcement – This gives markets hope that inflation will come down soon.

If you’d like to watch something on inflation, the video below is an excellent, if crass, look at the issue. As it’s John Oliver, this one comes with a language warning, as there’s some swearing througout the video. For this reason, you’ll need to click on the video for it to load, then click again to play it (we really want to make sure you want to watch this one).

Stats & Charts for Nerds

What we’re reading and watching

Inflation

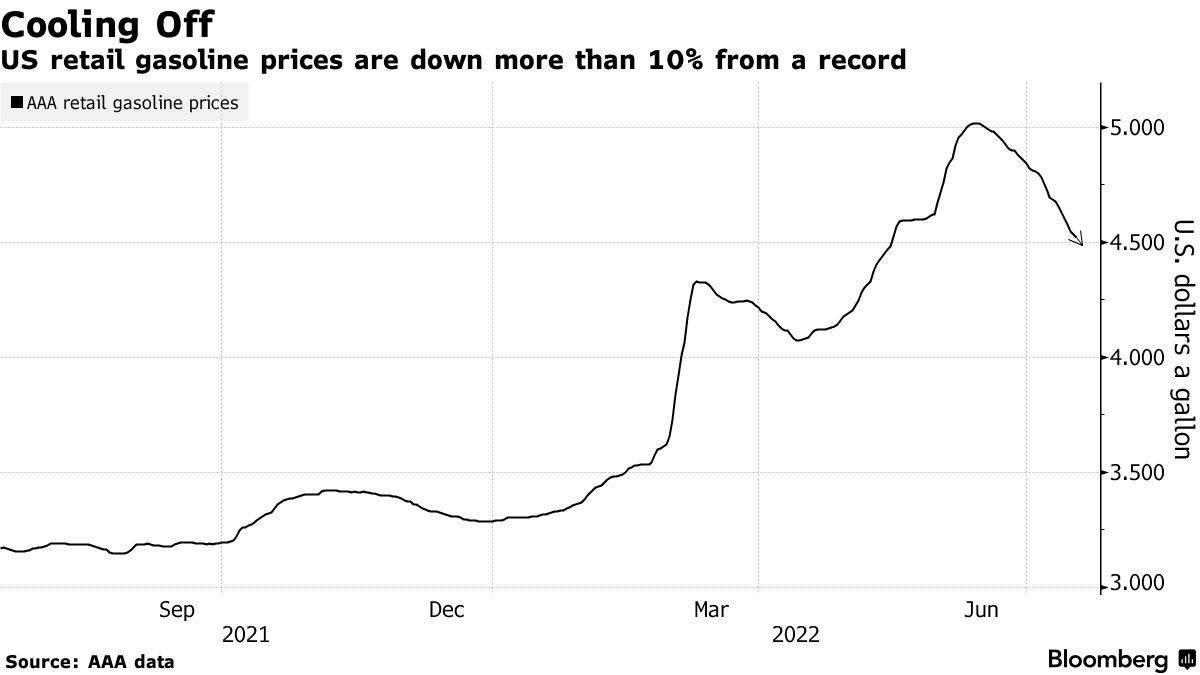

Let’s start with the facts – The Consumer Price Index, a widely used measure of inflation, rose 1.3% in June, and is up 9.1% from a year ago, which is the most prices have gone up in one year since November 1981. Go deeper into these numbers here. As you’ve no doubt experienced, a big part of this increase was the result of the recent extreme volatility in oil prices (driven partly but not entirely by the war in Ukraine), which have FINALLY started to fall. Here’s a chart:

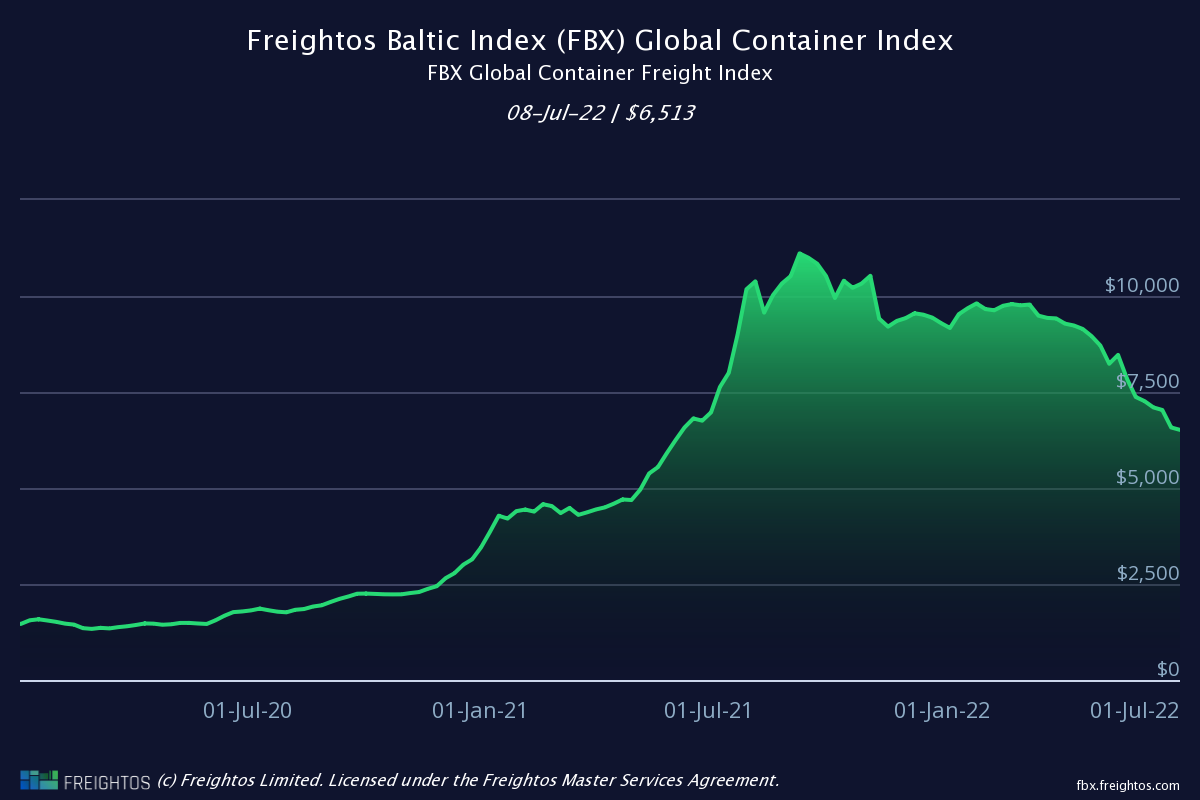

There’s other data we’re watching that shows a positive trend as well. Take this chart, which measures the cost of sending a shipping container across the ocean:

Take these two data points, along with the fact that major retailers are facing OVERsupply issues after the shortages of 2020 (more here), and we’re starting to believe that the worst of the last year’s inflation is behind us, but we’re still seeing headlines like “The Everything-Is-Weird Economy” (that’s a really good read by the way) and Mea Culpa’s from respected economists. We’re hopeful that we’ve just seen the worst of this inflation pass, but it’s worth noting that the Climate Crisis is also playing a role here, which is unlikely to change anytime soon.

Jobs

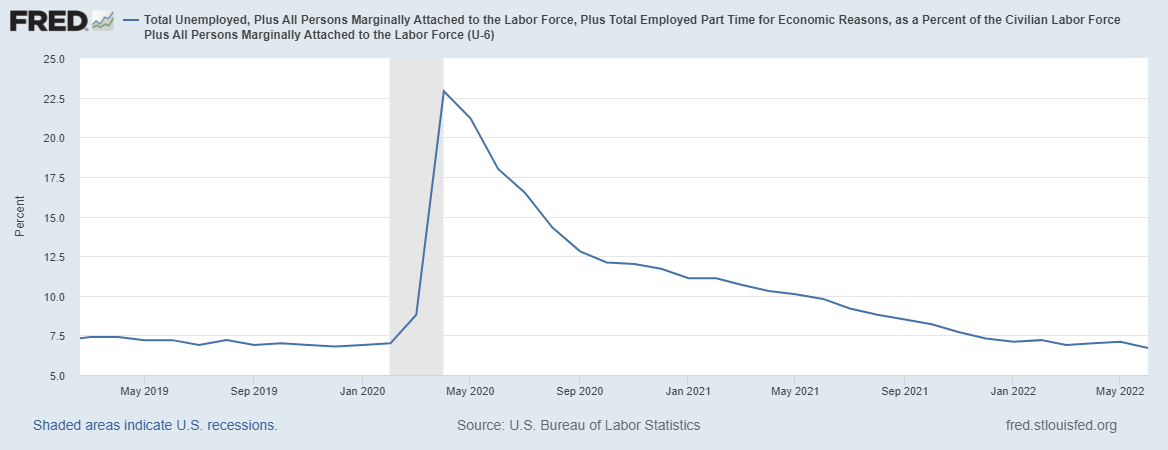

As we come out of the initial phase of pandemic-fueled uncertainty, it’s worth taking some time to look at employment numbers, since they give an extremely positive view of the economy. If you look at the U-6 unemployment rate, which is one of the broadest measures of how many people are employed (it includes people who are under employed for instance), it looks like we’ve recently hit the same, extremely low level of unemployment that we saw just before the COVID recession in 2020:

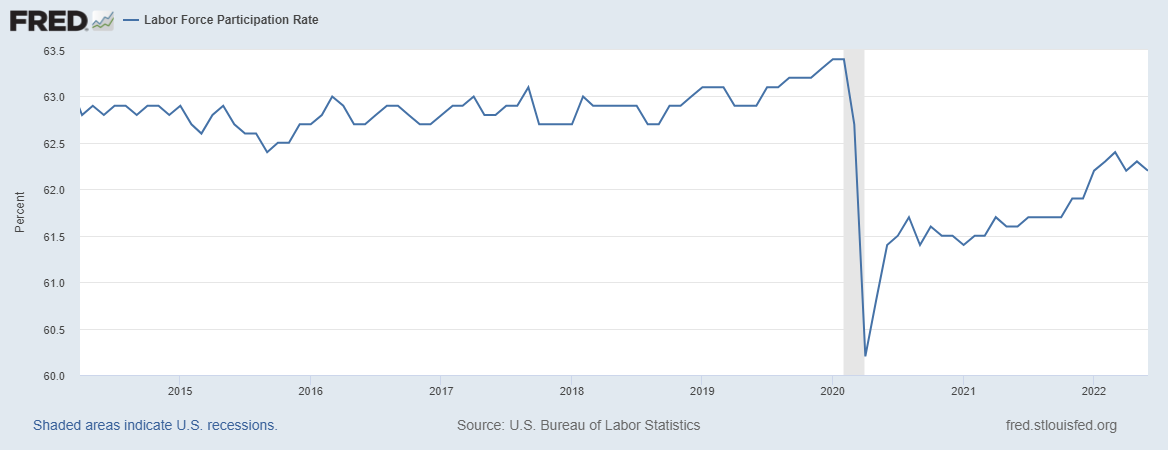

Looks good, right? By that chart, we should be back to ‘full employment‘. However, you need to look at this chart in the context of the ‘labor force participation rate‘, which is a measure of how many people are actively participating in the job market – effectively, the Unemployment rate measures the ‘demand’ of the job market, while the Labor Force Participation Rate measures the ‘supply’ of job seekers looking for work. Note how it has NOT recovered.

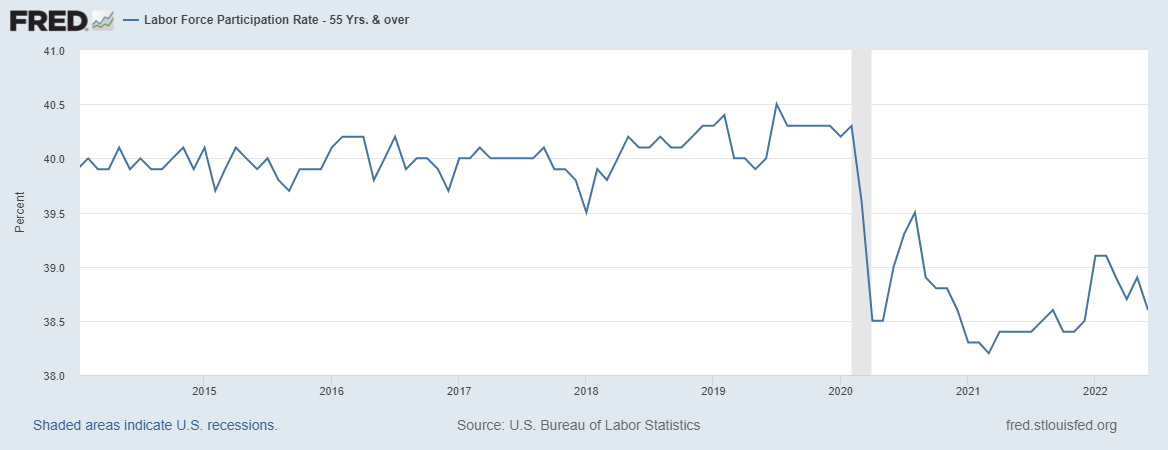

When we drilled down further, we noticed this chart, which just measures the labor force participation rate of older americans. It appears that many workers who were approaching retirement have been either forced out or took some kind of early retirement package. This confirms what we’ve been seeing and hearing from our clients, as we’ve been doing a lot of plans recently where people have been pushed out of work due to ageism in the workplace.

This is not good news, as the Federal Reserve’s decision making process is, in part, guided by these charts. The falling labor force participation rate could cause the Fed to believe that the economy is still running too hot, thereby encouraging them to continue with an aggressive rate-hiking plan, while putting the recently retired in a bind, where their plans have been based on working a few more years, they’re forced to retire earlier, and at the same time are seeing declines in their asset values and increases in their cost of living.

Interestingly, it also appears that Gen Z is entering the workforce at much higher rates than previous generations.

Recession?

Ok, we’ll admit, the title of this one is downright clickbait, so before you read any further, know this: the fundamental numbers in the economy look good, but there’s a non-zero chance that we’re going to have a recession in the next 18 months.

This study from McKinsey found that:

- While purchasing remains stable, higher prices are driving some consumers to spend differently, with about a third of them switching to private label grocery store brands.

- Some 75 percent of consumers switched brands during the pandemic, and the great loyalty shake-up continues, driven in part by the influence of social media on consumer behavior.

- Despite the explosion of e-commerce, consumers welcomed a return to stores, which continue to play a vital role, since companies who make the omnichannel experience seamless are winning.

and, interestingly for us, who focus on Sustainable, Responsible and Impact Investing:

- Values are starting to surpass the importance of value among younger consumers, with two thirds of Gen Z saying values are critical to their purchasing decisions.

While the economy is certainly undergoing a period of intense uncertainty, it’s not a foregone conclusion that we’re going to see a recession. Janet Yellen, the Treasury Secretary, said it well on Meet The Press the other day: “This is not an economy that’s in recession, but we are in a period of transition where growth is slowing. That’s necessary and appropriate, and we need to be growing at a steady and sustainable pace…”. The whole interview is well worth a watch, as it gets into the weeds on some of the technical definitions of a recession, which simply means that we’ve had 2 consecutive quarters of negative growth. Secretary Yellen did an excellent job of explaining a lot of what’s been in this update, while giving a good preview of what we’ll be watching in coming weeks.

Housing

One thing we can say for sure – the recent increase in interest rates has wrecked havoc on the housing markets. Homebuilder confidence is plunging as mortgage applications and refinances have tumbled. However, young would-be homebuyers are still being priced out of the market in many coastal and urban areas, and a ton of ink has been spilled on why. We expect it to take another 18 months to 2 years for the housing market to fully internalize the changes that have occured, so we’ve been having a lot of conversations with clients about putting cash to work in extremly short duration treasuries that are paying above 2% interest right now (on 7/25/22, the 3 month T Bill had a yield of 2.4%, which is very attractive given the low risk nature of these securities). Give us a shout if you’d like to talk about details.

Portfolio Changes

Please open the sections below to view our commentary and changes to the models.

Within each section is a series of links to Morningstar reports with changes.

On the last page of each report is an “Action Plan” that shows our Buy, Hold and Sell recommendations.

In addition to these changes, we will rebalance all accounts to bring them into alignment with the models. We anticipate implementing these changes by August 8, 2022.

All model portfolios are presented at a $100,000 value, & all performance numbers are quoted net of a 1% management fee.

As usual, there are also Impact Reports on each model. The new interactive reports will be available until Thursday August 11, 2022.

If you would like a custom impact report on your account, which may differ from the models if we’ve done any customization, please click here to take our values questionnaire, which was updated recently.

ESG Aggressive

The ESG Aggressive model has underperformed over the last year due to our underweight in energy, which is the only sector that’s up at all this year. As such, this portfolio has trailed it’s benchmark, although as oil prices have begun to drop, this underperformance has moderated, which you can see in the last 3 month timeframe. We’re actually quite happy with the long term performance of this model, and remind any clients invested in this model that it is designed for long term aggressive performance, which means that clients invested in this model should be prepared to ‘weather the storm’ by holding through periods of volitility like the one we’re currently seeing. There are no changes to this model at this time, but we will be rebalancing the accounts in this model to keep the positions within their ‘drift paramaters’.

We’d also like to share this piece from Matthews Asia – MISFX, the Matthews Asia ESG fund, is a holding in this portfolio, and this insight from the portfolio managers there is a useful look at how they approach responsible investing in Asian markets.

Click here for a morningstar report on this portfolio

Click here for an interactive impact report (note, this link expires: Thursday August 11, 2022)

ESG Moderate Aggressive

The ESG Moderate Aggressive model underperformed its’ benchmark significantly over the last year, primarily due to the fact that the model is significantly underweight energy stocks, which were the one sector of the economy that was up significantly so far this year. Performance was also held back by one of our sattelite positions, IYC, the iShares Consumer Discretionary ETF, which we will be selling at this rebalance. Coming out of the pandemic, we noticed that consumers were holding a lot of cash, and our thesis was that that pent-up demand would lead to increased discretionary spending. As it turns out, inflation took its’ toll, and a lot of the demand we anticipated flowing towards discretionary spending was eaten up by inflationary pressures. We’ll be selling this position to prevent further losses there. We’re also paring back our position in the Shelton Green Alpha fund, which had a spectacular year in 2020, but has underperformed badly this year. While we remain confident in this manager’s ability to deliver attractive returns over the long haul, we’re paring back the position to reduce the short term volitility in the portfolio.

Additionally, there has been a shift in the markets, which have favored a ‘growth’ style of investing for years, towards more of a ‘value’ style. We are also moving our portfolios in this direction slowly to account for this shift, and are adding the Parnassus Endeavor fund (PFPWX) to the portfolio, as it is currently invested in this way. We have been engaging in a number of dialogues with Parnassus in the lead up to adding this fund to the portfolio, and they shared with us this piece on their approach to sustainable investing.

Finally, we are continuing to shift our bond exposure to shorter duration bonds, through replacing half of the position in TIAA-CREF’s Core Impact Bond fund with a shorter duration version of that fund, TSDJX, the TIAA-CREF Short Duration Impact Bond Fund.

We’d also like to share this piece from Matthews Asia – MISFX, the Matthews Asia ESG fund, is a holding in this portfolio, and this insight from the portfolio managers there is a useful look at how they approach responsible investing in Asian markets.

Click here for a Morningstar report on these changes – look on the last page for an action plan.

Click here for an interactive impact report (note, this link will expire on Thursday August 11, 2022)

ESG Moderate

Our ESG Moderate model underperformed over the last year, primarily due to our underweight in energy, which was the only sector of the economy to be up significantly for the year. As oil prices have begun to fall in recent months, the performance of this model has tracked closer to the benchmark – we expect this trend to continue. Performance was also held back by one of our sattelite positions, IYC, the iShares Consumer Discretionary ETF, which we will be selling at this rebalance. Coming out of the pandemic, we noticed that consumers were holding a lot of cash, and our thesis was that that pent-up demand would lead to increased discretionary spending. As it turns out, inflation took its’ toll, and a lot of the demand we anticipated flowing towards discretionary spending was eaten up by inflationary pressures. We’ll be selling this position to prevent further losses there.

Additionally, there has been a shift in the markets, which have favored a ‘growth’ style of investing for years, towards more of a ‘value’ style. We are also moving our portfolios in this direction slowly to account for this shift, and are adding the Parnassus Endeavor fund (PFPWX) to the portfolio, as it is currently invested in this way. We have been engaging in a number of dialogues with Parnassus in the lead up to adding this fund to the portfolio, and they shared with us this piece on their approach to sustainable investing.

Finally, we are continuing to shift our bond exposure to shorter duration and higher quality bonds in this portfolio, through replacing half of the position in TIAA-CREF’s Core Impact Bond fund with PIMCO’s ESG Income fund, PEGIX.

We’d also like to share this piece from Matthews Asia – MISFX, the Matthews Asia ESG fund, is a holding in this portfolio, and this insight from the portfolio managers there is a useful look at how they approach responsible investing in Asian markets.

Click here to view a Morningstar report on these changes (head to the last page for an action plan)

Click here to view an interactive Impact Report (note, this link will expire on Thursday August 11, 2022)

ESG Conservative

The ESG Conservative model held up well over the last year despite minimal exposure to energy. However, there are a few tweaks we feel are appropriate at this time given the intense uncertainty in the markets. As this portfolio is used by our most conservative investors, we are making a few moves to continue to shorten the duration and increase the quality of the bonds in this portfolio. As such, we’re going to be selling 40% of the position in TIAA Cref’s Core Impact Bond fund (TSBIX) and all of the Pax High Yield bond fund (PAXHX) and add in TIAA Cref’s Short Duration Impact Bond Fund (TSDJX) and allocate additional capital to Pimco’s ESG Income Fund (PEGIX).

Click here for a morningstar report on this portfolio

Click here for an interactive impact report (note, this link expires: Thursday August 11, 2022)